AIM TO ACHIEVE BETTER OUTCOMES

The investment landscape ahead appears uncertain. Leverage our decades of experience in designing dynamic, multi-asset solutions so that you can focus on your clients’ needs and growing your business.

THE 3EDGE DIFFERENCE

Our unique approach is key to identifying investment opportunities while constructing properly diversified portfolios.

UTILIZING 3EDGE STRATEGIES

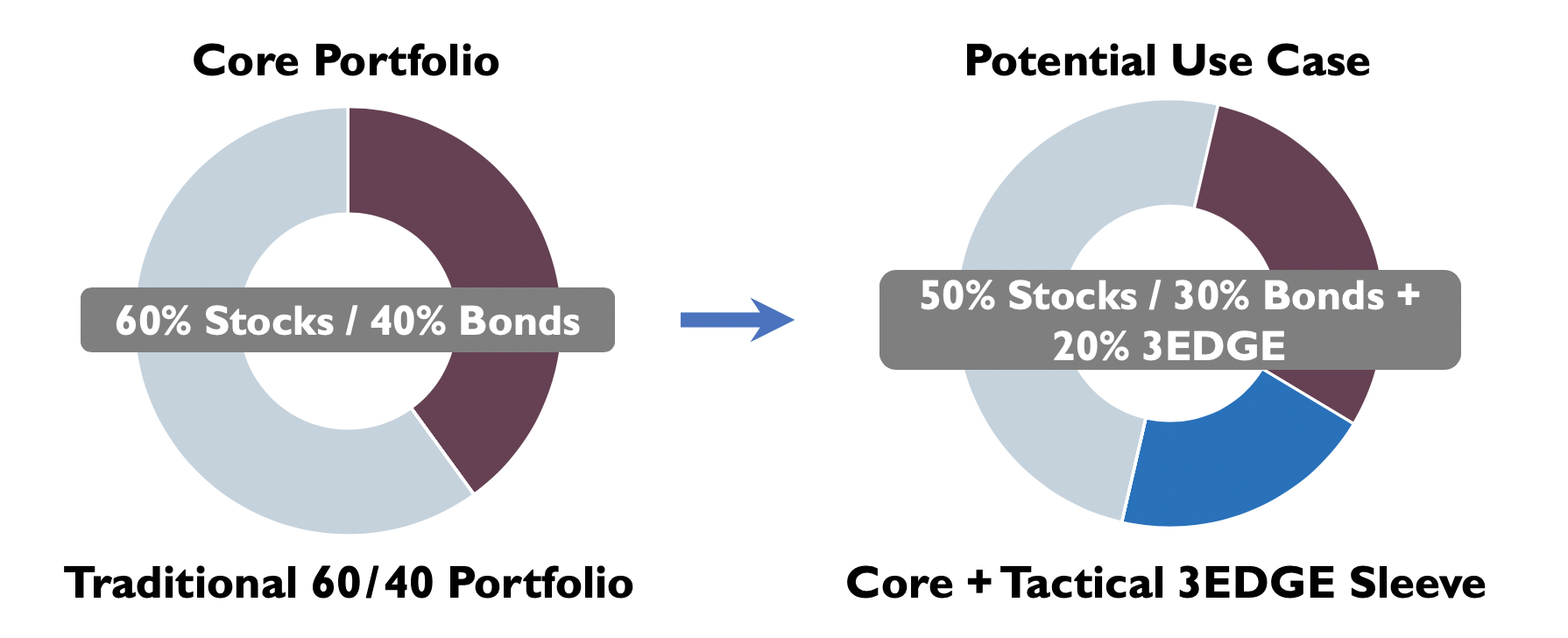

3EDGE Strategies can act as a complementary sleeve to a client’s overall investable assets or as an alternative asset to complement a traditional 60/40 portfolio.

Multi-Asset Core Solutions

3EDGE Conservative Strategy: Fixed Income complement or outright replacement

3EDGE Total Return Strategy: Complementary sleeve to a traditional 60% stocks / 40% bonds portfolio

3EDGE ESG Strategy: Complementing a core portfolio with an environmental, social and governance (ESG) focus

3EDGE Growth Strategy: Equity complement with a lower risk profile in terms of volatility and maximum drawdown

3EDGE ESG Aggressive Strategy: Equity complement utilizing ESG focused ETFs

Multi-Asset Income Solution

3EDGE Income Plus Strategy: Active, tactical income generation solution balancing yield, return and risk

All Equity Solution

3EDGE Global Equity Strategy: Global equity complement or outright replacement of ACWI holdings

Crypto Solution

3EDGE Crypto Plus Strategy: Disciplined approach to investing in crypto currency providing an alternate store of value

We keep RIAs informed when we make strategy changes, share our monthly outlook for the global capital markets and offer Quarterly Webinars to stay in touch. Contact us to discuss how we can put our expertise to work for you.