COMBINING HUMAN + MACHINE

Traditional quantitative analysis and black box approaches are almost entirely data-driven or inductive in nature. We believe using only this approach can be fraught with risks.

Our approach is both deductive and inductive, a result of over four decades of studying global capital markets across many cycles.

- Deductive: First, we arrive at the essential theories that explain the cause-and-effect relationships that drive the global capital markets.

- Inductive: We then test these theories through robust quantitative modeling with data going back over 150 years.

THE THREE DIMENSIONAL RESEARCH PROCESS

Modeling valuation factors, global macro-economic factors, and investor behavioral factors

01

Valuation Factors

Our objective is to make investments in undervalued asset classes that are poised to begin a period of market outperformance assisted by catalysts which may be macro-economic or behavioral in nature, or both.

Unlike traditional valuation measures, which focus on a fair-value equilibrium state for a particular asset, we believe that the global capital markets constitute a complex system of cause-and-effect relationships. In market terms this means that assets are rarely static, but instead tend to move dynamically through various states of disequilibrium, fluctuating between undervalued and overvalued.

02

Global Macro-Economic Factors

We believe a great deal of information about the future direction of the capital markets is embedded in the levels of and rates of change of nominal and real interest rates around the globe, yield curve slopes and various credit spreads.

- How changes in central bank monetary policy may impact inflation expectations.

- How changes in relative, real long-term yields may affect equity prices, bond yields and currencies.

- How changes in interest rates may affect global capital flows.

- How changes in the TED spread (interbank lending rate less the treasury bill rate) may indicate liquidity issues in the banking sector and subsequent headwinds for equity markets.

- The level of and change in currency prices of the U.S. dollar, euro, yen, yuan and pound sterling.

- How long-term yields may impact the discount rate and therefore asset valuations; and

- How the slope of the yield curve may affect projected normalized earnings.

03

Investor Behavioral Factors

Global macro-economic and valuation factors by themselves may not be sufficient in explaining the future direction of the global capital markets.

At times, herd mentality can result in self-reinforcing feedback loops that may affect asset prices rather dramatically in a short period of time, positively or negatively. We also analyze price actions of various indices in our investment universe. However, it is also important to consider investor behavioral factors in relation to the macro-economic backdrop and to not just rely on price action in and of itself.

PORTFOLIO CONSTRUCTION METHODOLOGY

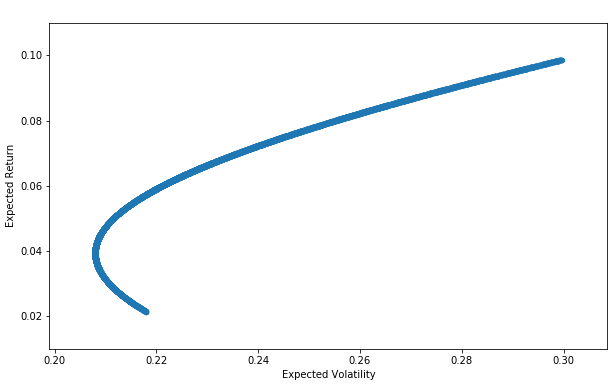

Conventional approaches only solve for Return and Volatility while assuming static correlations across time.

MODERN PORTFOLIO THEORY

Our model simultaneously solves across CAGR (Compound Annual Growth Rate), Sharpe Ratio (returns relative to volatility/risk), and Maximum Drawdown (potential maximum peak to trough loss) in aggregate for the combined asset classes that make up our investment universe which ultimately produce each portfolio strategy we manage for our clients.

3EDGE COMPREHENSIVE APPROACH

Output from our model research serves as our navigation system, informing our dynamic portfolio allocation decisions.