Equities:

Equities:

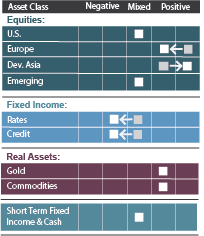

The outlook for U.S. equities remains mixed. Valuations continue to be stretched to historically high levels, sparking comparisons to bubbles that have occurred throughout market history. While the Fed insists that recent inflationary pressures will prove temporary, inflation could last longer and become more problematic during the remainder of 2021 and beyond. The U.S. equity market appears to be driven by continued Fed-driven liquidity and a continuing flow of cash and margin dollars from retail investors in a wave of momentum-based investing. Concerns regarding the timing and size of the Fed’s tapering of its $120B per month of bond purchases (quantitative easing) and the corresponding market reaction highlight risks for U.S. equities.

Japan equities recently reached a five-month high and are continuing to benefit from relatively attractive valuations, positive investor behavior and market momentum. These positives may have manifested as a result of the recent announcement that Prime Minister Yoshihide Suga will not seek a second term, since he has been criticized for his handling of the COVID-19 pandemic in Japan. Lastly, there exists a real possibility that the Bank of Japan may feel compelled to add additional stimulus measures to the Japanese economy.

European equities which have rallied year-to-date continue to be supported by monetary stimulus from the ECB and positive investor behavior. However, a risk to this outlook is the continued upward pressure on European inflation which may result in the ECB changing tack by tightening their policies sooner than previously anticipated.

The outlook for China equities remains mixed. There is a good deal of uncertainty among investors about recent policy decisions by the Chinese government and the potential negative effects that such policies may have on both the Chinese and the global economy. However, much of this may already be priced into Chinese equities and steepening yield curve measures could be a positive sign for the region.

India equities which recently reached record highs, continue to be bolstered by positive investor psychology, declining short-term interest rates and a commensurate steepening of the yield curve. Accommodative monetary and fiscal policies are expected to continue heading into the upcoming elections. Interestingly on the geopolitical front, the situation in Afghanistan could bring the U.S and India closer together since Pakistan is an ally of the Taliban.

Fixed Income:

The risk/return trade-off in U.S. Treasuries remains uncompelling as the entire Treasury yield curve continues to yield less than the expected rate of inflation.

Credit spreads remain near all-time low levels – risks of a rapid unwind combined with the very small extra yield pick-up relative to Treasuries suggest an unattractive risk/reward profile for corporate bonds. In addition, should the global economy slow from here, it could cause problems in the high yield bond markets, and we could see high yield spreads widen.

Real Assets:

Although Gold has struggled thus far in 2021, it remains a relatively attractive asset class and continues to be supported by negative real yields (nominal yields less expected inflation). In addition, concerns around the Delta variant, peak-growth and an uneven recovery in labor markets could delay the Fed’s plans to taper and lead to higher gold prices.

Commodities are now less attractive than they have been in previous months amidst an increase in negative investor psychology towards the asset class. Investors may also be concerned about the recent restrictive government policies in China which may slow the Chinese and overall global economy thereby decreasing demand for commodities. However, commodities remain attractive in the medium to longer-term since they remain relatively undervalued particularly compared to U.S. equities.

About 3EDGE

3EDGE Asset Management, LP, is a multi-asset investment management firm serving institutional investors and private clients. 3EDGE strategies act as tactical diversifiers, seeking to generate consistent, long-term investment returns, regardless of market conditions, while managing downside risks.

The primary investment vehicles utilized in portfolio construction are index Exchange Traded Funds (ETFs). The investment research process is driven by the firm’s proprietary global capital markets model. The model is stress-tested over 150 years of market history and translates decades of research and investment experience into a system of causal rules and algorithms to describe global capital market behavior. 3EDGE offers a full suite of solutions, each with a target rate of return and risk parameters, to meet investors’ different objectives.

Podcast: Play in new window | Download